In recent years, Big Data has been utilized in various fields, such as retail, manufacturing, healthcare, and the insurance industry. In particular, there are insurance companies that work with companies in different industries to utilize Big Data for product development.

In this article, we will focus on examples of how Big Data is utilized in the healthcare and insurance industries. We will also explain the challenges faced by insurance companies in data collection and the relationship between Actuaries and data utilization.

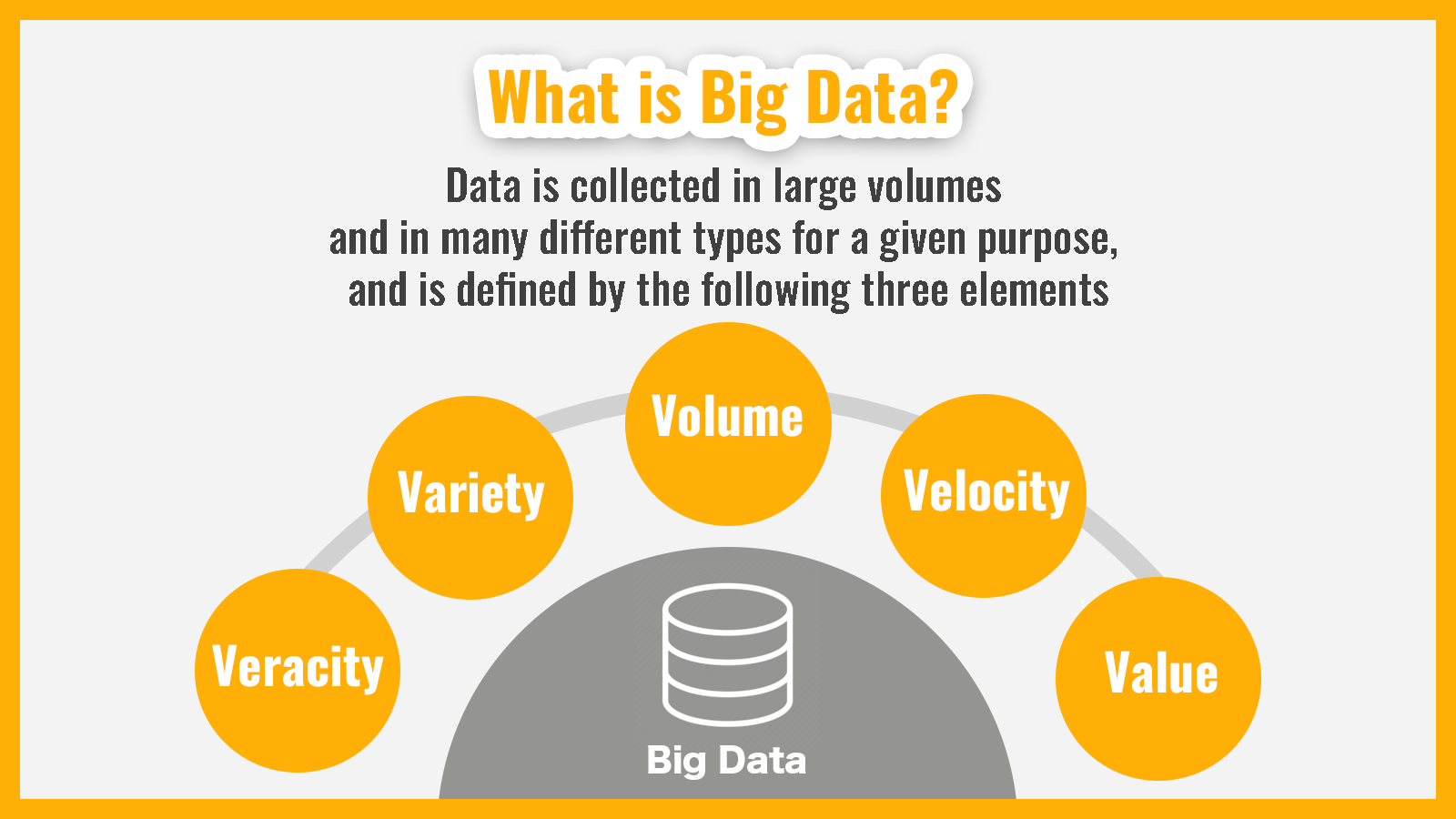

What is Big Data?

Big Data is defined by the following five elements

- Large amounts of data collected for a specific purpose

- Data that is diverse and comes in a variety of formats

- The need for speed in processing and analyzing data

- The veracity, or accuracy, of the data

- The value derived from the data

Generally, data is managed in table format with rows and columns, but Big Data includes unstructured and non-standardized data, such as documents, images, and social media messages.

Benefits of Utilizing Big Data

Utilizing Big Data provides the following three benefits

- It enables companies to make more informed decisions by using data to analyze trends and patterns.

- It can lead to cost reductions by optimizing operations and minimizing waste.

- It can create new opportunities for revenue growth by developing innovative products and services.

In particular, the insurance industry has been utilizing Big Data to develop innovative products and services. For example, Actuaries play an important role in designing insurance products by utilizing data to assess risk and predict customer behavior.

Finally, we will discuss the development and utilization of medical data in insurance products. MDV, for instance, owns medical data and hopes to strengthen collaboration with the insurance industry in utilizing it for product development.

Examples of the utilization of big data

Big data has been used in industries such as retail, manufacturing, and tourism for some time. However, in recent years, it has also been used in the medical and insurance industries. Below are some examples of the use of big data in the medical and insurance industries.

Medical Industry:

In the medical industry, medical institutions use aggregated data from medical records and receipts to analyze treatment and develop new drugs.

Examples

- Electronic medical records allow for comprehensive treatment by linking symptoms and treatment information for each disease.

- Analysis of CT and X-ray image data allows for early detection and early treatment by finding similar cases from past patient data.

- Discovering effects and side effects that cannot be confirmed in clinical trials, and smoothing the development of new drugs.

Insurance Industry

In the insurance industry, big data is used to provide insurance products and support sales staff.

Examples

- Analyzing customer information and health check results and reflecting them in (some) insurance premiums.

- Collecting customer health information from smartphone apps and wearable devices to provide customer health support.

- Predicting the signing of specific insurance products from customer information and supporting sales staff.

Furthermore, a life insurance company conducted joint research with other companies to use medical big data in their life insurance business and developed a quantitative evaluation model to predict the possibility of hospitalization due to lifestyle diseases and the number of days. By reviewing the underwriting criteria for insurance, there are cases where customers who had difficulty joining insurance due to their health condition can now join.

◆Related articles

What is big data? Explanation of definition and usage methods

The use of big data is advancing in the insurance industry

As mentioned above, big data is being used in various situations such as the development of insurance products, customer health support, and sales support for sales staff in the insurance industry.

Below, we will explain in more detail the types of data that insurance companies use and the situation of the utilization of big data in overseas insurance companies.

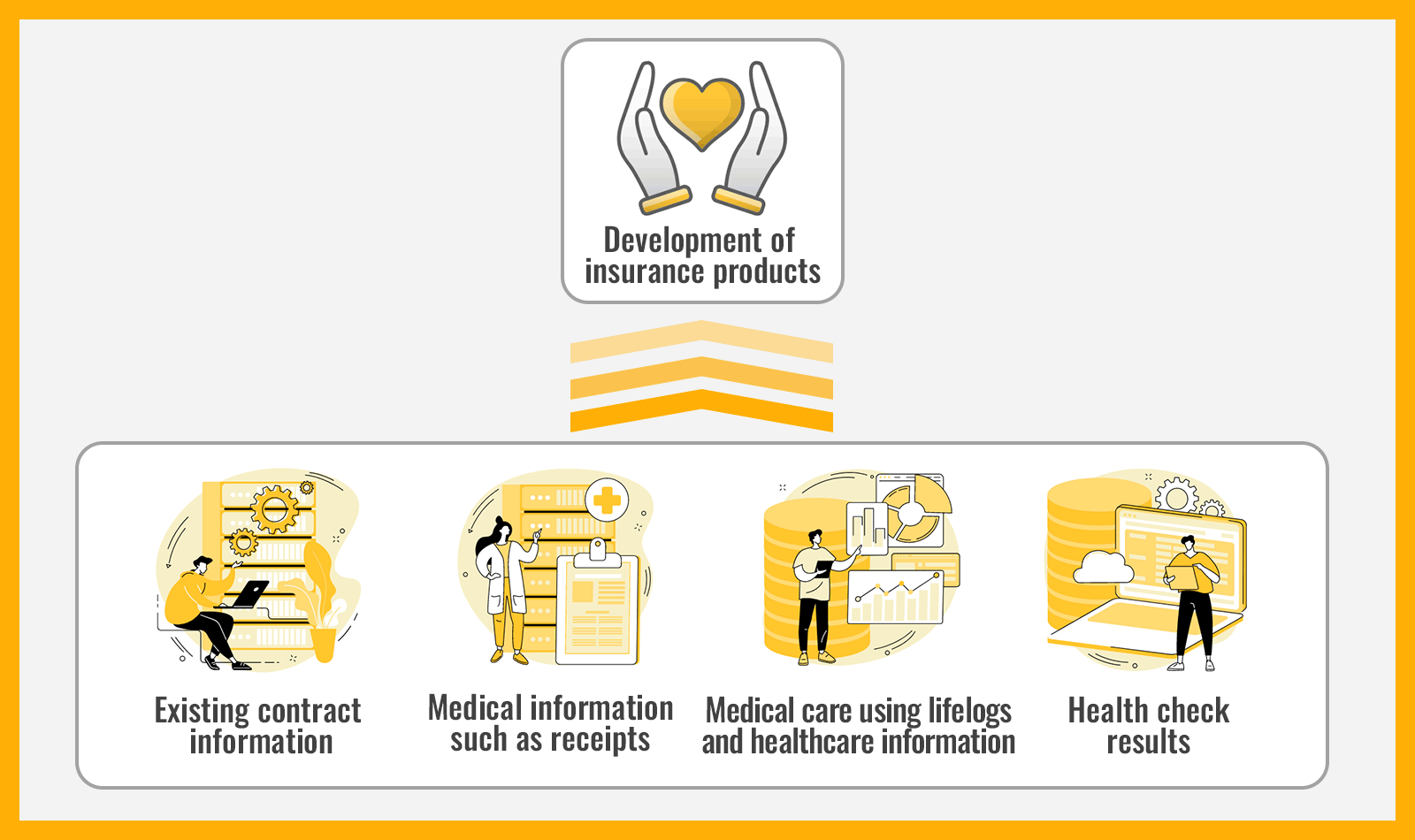

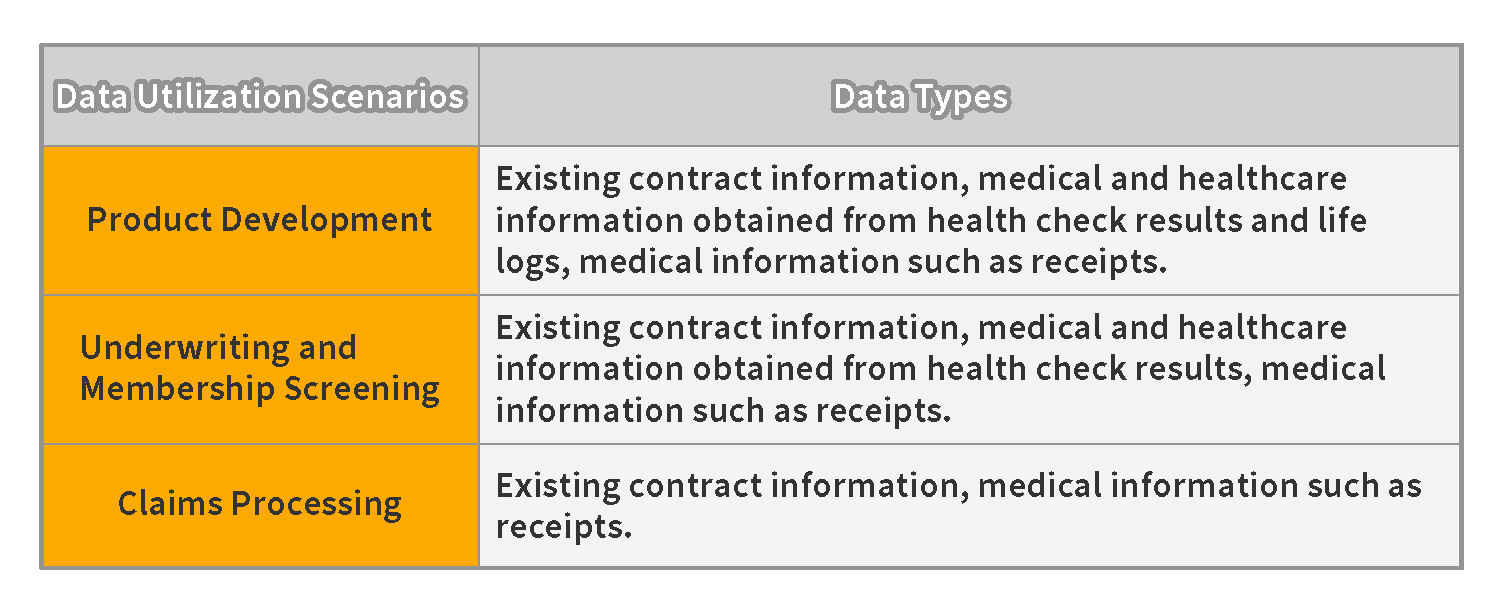

Types of data used by insurance companies

In the past, insurance companies mainly managed customer information as data necessary for insurance enrollment and various insurance-related procedures such as preservation and collection. However, in recent years, insurance companies have started analyzing and utilizing external medical information such as receipts as big data.

The types of data utilized in insurance companies are as follows:

The use of Big Data in overseas insurance companies

The use of big data is also progressing in overseas insurance companies, and one characteristic is that private insurance companies in China share and utilize data within their affiliated groups. Until recently, the mainstays of this insurance company’s business were “insurance,” “banking,” and “investment.” However, in recent years, they have started “fintech,” which combines financial services and information technology, as a new pillar, and have developed a “internet + comprehensive finance” strategy.

This insurance company has invested a significant amount of money in the fintech field and has begun support services for predictive technology, decision-making technology using AI, and influenza and other epidemic forecasts, in addition to biometric authentication such as voiceprints and faces. The big data and technology held by this insurance company’s group are also having an impact on public insurance systems.

Challenges in data collection for insurance companies

Although the utilization of big data is being promoted in insurance companies, a challenge in data collection is that there is little variety in the data and the update frequency is low. Insurance companies only have the necessary data for insurance-related matters, and they do not have much data other than existing customer information. The narrow range of analysis due to the small amount of data owned has made the utilization of big data limited. Furthermore, most of the data they have is still the same as when the contract was signed because data is usually not updated unless there is payment of insurance or benefits.

Increasing the variety of data and increasing the frequency of updates will increase the diversity of correlation relationships discovered by data analysis. However, increasing the variety of data is difficult in insurance companies because data collection is mainly related to insurance contracts.

Therefore, it will be necessary to collect data from outside the company to increase the variety of data in the future.

The future of big data utilization in the insurance industry

By obtaining and analyzing a variety of data, insurance companies can develop new insurance products and propose personalized insurance products for each customer.

For example, it is possible to provide insurance products tailored to the customer’s health status at insurance premiums that are suitable for the customer. In addition, by analyzing financial transaction information and purchase information, it is also possible to propose insurance products such as pension insurance and education insurance tailored to the customer’s preferences

To analyze data as an insurance company, it is necessary to have knowledge of the insurance industry and each company, the ability to understand the theoretical background that supports machine learning, and the ability to implement and operate data science. Therefore, in the future, the active involvement of actuaries and IT engineers who handle mathematical operations is expected to be even more important.

The relationship between actuaries and data utilization

In utilizing Big Data, the existence of actuaries is essential. Actuaries are specialized professionals who handle mathematical operations in the fields of life insurance, casualty insurance, and pension insurance. They analyze accident occurrence rates, loss amounts, and other statistics using probability and statistical methods based on statistical data related to economics, medical care, natural disasters, etc. They are also involved in calculating insurance premiums and developing insurance products.

The number of actuaries was about 5,000 in 2017, but as of the end of March 2022, it has increased to about 5,500. As the use of Big Data in insurance companies continues to advance, it is expected that the number of actuaries will increase further. Actuaries are mainly employed by life insurance companies, casualty insurance companies, trust banks, etc., but in recent years, their fields of activity have expanded to various government agencies and consulting companies.

Medical Data Vision Co., Ltd. has the largest medical database in Japan and can provide analysis and data provision tailored to client companies’ orders. If you are considering utilizing medical Big Data for insurance development, please feel free to contact us.